Back-Up Child Care

Even the best planned child care arrangements can be disrupted from time to time. Benefits-eligible faculty and staff can access back-up in-home or center-based child care for up to 10 days every year.

When to use back-up care

This benefit is intended to be used:

- When your regular caregiver is ill or temporarily unavailable

- When you are between child care arrangements

- When your child's school is closed

- To ease transition back into a regular work schedule when returning from leave

- To accommodate changes in flexible work arrangements

This benefit is available for a maximum of 10 days for faculty and staff per calendar year. If care that is typically covered is unable to be provided, reimbursable care of $100 per day may be offered to offset the cost of care sourced on your own. Each reimbursement day counts as a back-up care use.

Please note that this service is not designed for emergency back-up child care situations, and you will have the best chance of securing care if you reserve in advance.

Did you know we also offer 10 days of back up care for adult/elderly care?

How it works

Step one: Log into the Bright Horizons portal with SSO

Stanford partners with Bright Horizons to deliver the back-up child care program. When you become aware of a back-up child care need, please log onto the Bright Horizons portal using the button below via Single Sign-on (SSO). Your information will be pre-filled, you just need to check the box to agree to the Bright Horizons Privacy Acknowledgement and Acceptable Use Policy.

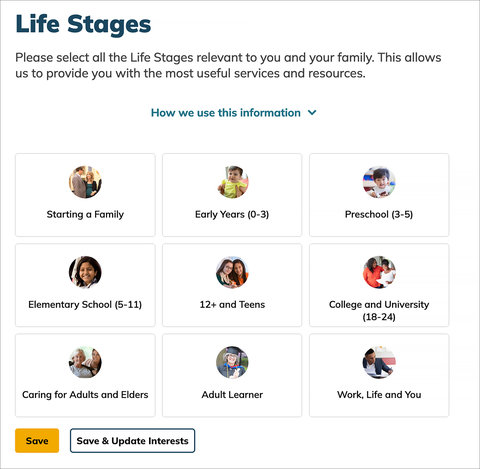

Step two: Confirm your interests

Once you are in the Bright Horizons portal, select the life stage that applies to you and your family.

We encourage you to explore the portal to see all the benefits available to you, including financial support for undergraduate or graduate degree programs.

Step three: Reserve back-up child care

Click on the "Back-Up Child Care” tile on your portal. From there, you can follow the prompts and reserve the child care option that is best for your needs:

In-home: For in-home care, there is a $6/hour co-pay, with a 4-hour minimum and a 10-hour maximum per day.

Center-based: For center-based care, there is a $15/day co-pay per child, with a maximum of $25 per family/day.

Access the Bright Horizons portal

Note: Make sure you turn off your pop-up blockers to ensure the smoothest experience in the portal.

Frequently asked questions and support

If you have further questions, please review these Frequently Asked Questions. If you still have questions, please contact Bright Horizons directly on 877-BH-CARES (242-2737).

Didn't use all 10 days of dependent care this calendar year?

Explore the Bright Horizons portal to see other ways you can apply the benefit, including:

- Back-up self care for when you’re recovering from an illness or need extra help

- Back-up care for in-home adult or elderly care

- In-person School Vacation, Holidays and Summer Camps

- Virtual camps boasting a wide range of award-winning online classes and clubs

Marketplace Discounts

Our partnership with Bright Horizons also unlocks a number of discounts, including:

- Preferred enrollments and partner discounts at Bright Horizons childcare centers

- Premium membership to SitterCity and YearsAhead to help you find caregivers

- Nanny placement discounts through Jovie

- Tutoring discounts with Revolution Prep, Sylvan Learning, and Varsity Tutors

- Camp and Enrichment discounts with Steve & Kate’s, Code Ninjas, Marco Polo, and Right at School

Tax information

Usage of Stanford's back-up care program is an employer-sponsored service that will be reported in Box 10 on your W-2. Dependent care benefits include your pre-tax contributions to your dependent care FSA. Also included are eligible amounts paid by your employer to you or to your day care provider and the fair market value of dependent care in a facility provided by or sponsored by your employer. The fair market value of dependent care services that exceed the non-taxable limit of $5,000 allowed for the FSA is listed in boxes 1, 3 and 5 of the W-2 form. You must complete Form 2441, Child and Dependent Care Expenses, to compute any taxable and nontaxable amounts. For further guidance on this topic, and to review any questions you may have, please contact a tax professional or the IRS directly (www.irs.gov).

NOTE: As part of Stanford University's employee benefit programs, you have access to certain resources which you may use to find care and other service providers meeting your unique needs and budget. Your use of these services is at your sole risk. You are responsible for the care/services you arrange, including the quality and the cost of the care/services, and for conducting any desired criminal records checks or other screening on any potential providers. Stanford University does not employ, recommend, endorse or screen any providers. Stanford University makes no representations or warranties about the quality of the care or other services provided by the providers or other third parties or about your interactions or dealings with any such parties.